Volatility describes periods of unpredictable, and sometimes sharp, market rises and falls. It’s natural, but unnerving. Let us guide your pension planning.

Whatever you do, don’t panic.

The value of investments rise and fall for all sorts of reasons – interest rate hikes, geopolitical changes, company announcements… the list goes on. And while these movements – otherwise known as volatility – might make you feel uncomfortable, they’re part and parcel of investing.

Stay focused on the long-term

Markets can – and have – recovered over time (although there are no guarantees). Look at long-term projections instead of current performance.

Avoid making rash decisions

If you’re over 55 (57 from 2028) and thinking of withdrawing money in the hope of minimising losses, this could be risky as it might mean missing out on any potential future gains.

Keep some cash set aside

Make sure you have money set aside for emergencies. This way you won’t be forced to withdraw from your Plan, which is designed to prepare your after work life.

Review your investment strategy

If your pension isn’t in the default strategy, check your own strategy is still in line with your goals and objectives.

Seek guidance or advice

You can talk to someone at The Financial Planning Group for reassurance, we are always happy to chat.

Time to recover – why it pays to stay invested

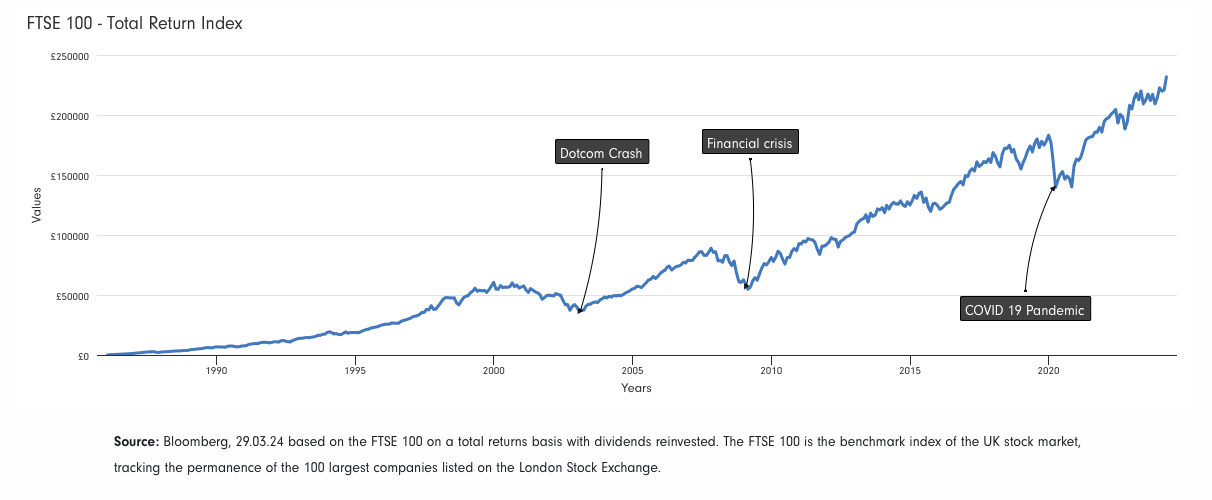

Investing is for the long term. Setbacks happen, but history shows that markets have recovered. Here’s what happened if you invested £100 each month in the FTSE 100 – and stayed invested – since January 1986.

Take care of your pension. And it will take care of you.

When the value of your pension pot falls, or you’re feeling financially squeezed (whether that’s due to the cost-of-living crisis, you’re saving for a house, having a baby or thinking about changing career), it can be tempting to lower your pension payments. Or worse, stop them altogether. But if you’re going to be able to afford the retirement you want, you might want to think again. Your future self will thank you for keeping at it in the long run.

Nearing retirement?

When you get close to retirement, any sudden change to your pension value can be worrying. The impact of inflation can also be daunting. It’s important to think through your options and, if possible, speak to an authorised financial adviser.

Here at The Financial Planning Group we help individuals, families and businesses to place their financial affairs in context with their future goals and aspirations. We provide a simple, structured, disciplined and reviewable planning service that helps our clients change the fundamental relationship they have with their money to give them confidence and clarity in their own future.

If you would like to speak to us about a medium to long term strategy for your pension provision, please contact us to arrange a meeting in our office in central Teddington by calling Alan Clifton on 020 8614 4780 or emailing him at alan.clifton@fpgonline.co.uk